扫一扫又不会怀孕,扫一扫,作业无烦恼。

留学顾问の QQ:2128789860

留学顾问の微信:risepaper

需要什么,尽管吩咐!

本咨询中心,擅长包含并不限于上图中的数据处理工具,敬请下单!相信没有什么挑战是战胜不了的,就算是超难的tasks。

TO COMPLETE THIS COURSEWORK, YOU REQUIRE 代写SAS SOFTWARE.

Section A: Required

You will prepare a credit report for the portfolio of three bonds shown in Section B.

Section 1: Distribution of Portfolio Values

- Provide a chart of the range of future portfolio values.

- What is the mean and standard deviation of the future value of the portfolio?

- Calculate the 1% and 0.1% levels of the portfolio value. Thus state, there is a 1% (0.1%) probability that the value of the portfolio will be _____ or less; with 99% (99.9%) confidence the portfolio will not fall below _______.

- Compare the portfolio values with the 1% and 0.1% levels suggested by the normal distribution.

Section 2: The Contribution of Individual Assets to Portfolio Credit Risk

- Calculate the mean and standard deviation of the future value of each asset, Firm 1, Firm 2, Firm 3 and set this out in a table.

- Calculate the standard deviation of two-bond portfolios made of different combinations of the three bonds and thus calculate the marginal standard deviation of each bond.

- Produce a table which is similar to Table 11.5 on page 130 of the Credit Metrics document showing the current value of each bond, the standalone standard deviations and the marginal standard deviations

- Produce a scatter plot of the % marginal standard deviation against the credit exposure

Section B: Data

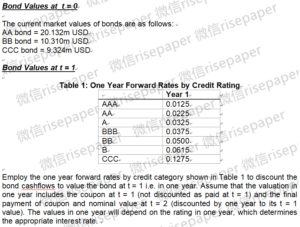

The 3-bond portfolio consists of three 2-year bonds as follows:

- Firm 1 – AA rating – nominal value of 20m USD – 2% coupon

- Firm 2 – BB rating – nominal value of 10m USD – 5% coupon

- Firm 3 – CCC rating – nominal value of 10m USD – 12% coupon

For confident SAS users, this is an alternative to Workshop 4. If you are not confident, please move to 6. Below.

Use SAS to calculate bond values and transition points in terms of z-values.

For example, to calculate the value for Firm1 (AA bond) at an AAA rating in SAS use this code:

F1_AAA = 0.02 * 20 + (1.02 * 20) /1.0125;

To calculate the transition points in terms of z-values for Firm 1 in SAS use this code:

Zdef_F1 = probit(0.0002);

ZCCC_F1 = probit(0.0005);

ZB_F1 = probit(0.001);

ZBB_F1 = probit(0.003);

ZBBB_F1 = probit(0.015);

ZA_F1 = probit(0.05);

ZAA_F1 = probit(0.935);

You can then run the below code to combine this into the ratingmap values as follows:

data acw.ratingmap1;

set acw.ratingmap;

if _n_=1 then do;

set acw.values;

end;

run;

The next steps of your code will then be:

data acw.ratingmapA;

set acw.ratingmap1;

length FIRM1 FIRM2 FIRM3 $ 7;

* FIRM 1;

if x1 ge ZAA_F1 then Firm1 = ‘AAA’;

else if x1 ge ZA_F1 and x1 < ZAA_F1 then Firm1 = ‘AA’;

Now use frequencies and means procedures to complete the assignment:

proc freq data = acw.ratingmapB;

tables portval / norow nocol;

run;

proc means data = acw.ratingmapB mean stddev p1 ;

var portval v1v2 v1v3 v2v3 value1 value2 value3;

run;