扫一扫又不会怀孕,扫一扫,作业无烦恼。

You must include your 代写VBA codes and Do.file in the Appendix. Failure to do so will result in 20 marks being deducted.

- 最近的元宇宙新领域掀起了不少的讨论风波,毫无疑问,元宇宙是眼下疫情远程办公和在线交流的产物。相信在不远的将来,即使是online exam,也跟亲自去教室考试差不多!到时候,各种小动作会不会无所遁形!

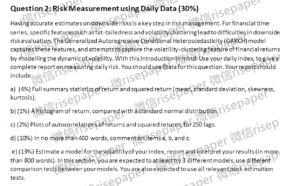

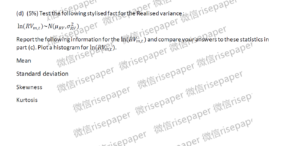

- Estimate a model for the volatility of your index, report and interpret your results (in more than 800 words). In this section, you are expected to at least try 3 different models, use different comparison tests between your models. You are also expected to use all relevant post-estimation tests.

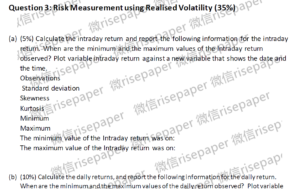

- (10%) Calculate the daily returns, and report the following information for the daily return. When are the minimum and the maximum values of the daily return observed? Plot variable Daily return against variable date.

Observations

Standard deviation

Skewness

Kurtosis

Minimum

Maximum

The minimum value of the Realised Volatility was on:

The maximum value of the Realised Volatility was on: - 举一个简单的代写excel VBA应用例子,Now add code to your macro so that in your worksheet you

generate a sequence of 31 prices P1; :::; P31 in the column next to the returns you

generated in Example 9.1. Use the nal price P31 to calculate the payo to a long

put with expiry at time t = 31 and exercise price 4. (Put this formula on the column

next to prices.) - Upon opening the SP500Data.xlsm le, the rst thing we want to do is make the

columns an appropriate size. - UNIVERSITY OF EAST ANGLIA

SCHOOL OF ECONOMICS

ECO-7017B Risk Management and Trading - egen SUM=sum(R2), by(D)

The command above generates a new variable, `SUM’, sum of squared returns

within the day.