留学顾问の QQ:2128789860

留学顾问の微信:risepaper

The University of Melbourne

Department of Finance

Special Final Exam

FNCE20005 CORPORATE FINANCIAL DECISION MAKING代写代考exam

Semester TWO, 2021

Exam Duration: Three (3) Hours writing time

15 minutes reading time

30 minutes upload time (Section B – Gradescope only)

跨年即将到来,小编的键盘一直没有停歇,是的,从今年的一月一号开始,没有半天是停滞的状态!今年绝对是爆单的一年,高开高走的一年,感谢所有老客户的支持,感觉再劳累也是值得的!

此门课小编这里一共接过两次,一次是正式的exam,一次是resit exam,大约助攻过6名同学过关。主要特点是选择题分值特别高,计算复杂,会花费一半以上的考试时间!

- Pinder Ltd has the option of borrowing-to-buy the truck or to lease the truck, where the lease payment is $25,000 per year and would be due in advance each year. Should Pinder Ltd lease or borrow to buy?

- Assuming that the appropriate discount rate for the evaluation is 11% per annum (after-tax), what takeover premium (measured as a percentage of current share price) would Diacono Ltd have to offer Midgley Ltd shareholders in order to split the gain equally between the two shareholder groups? (Show all your work. Answer must be handwritten)

- After the bid, there will be 15m + X shares where X = the number of shares issued to HRU shareholders.

X / [15m + X] = 0.159515 => X = 2.846838m

There were 1.2 million HRU shares, therefore the exchange ratio is 2.372365 FPI shares for 1

HRU share. - it can be difficult to specify the distribution of values that a variable might take – which is exactly what is required for an analyst to arrive at their “optimistic” and “pessimistic” values.

- We use the indirect method in calculating the cash flow from operating activities. We start from net income and add back non-cash expenses such as depreciation and amortization, and adjust for change in working capital.

- Non-Linear Taxes

•Most tax codes in the world are progressive, i.e. convex.

•Tax rate is higher for higher pre-tax income.

•Reduction in volatility of taxable income can lower expected aggregate taxes for firms with convex effective tax functions.

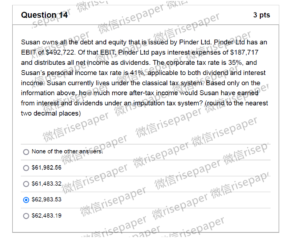

•By reducing the effective long-term average tax rate, any strategies that reduce volatility in reported earnings may enhance shareholder value. - The Impact of Taxes on Capital Structure under an Imputation Tax System

•Under the imputation tax system, company taxes and personal taxes are integrated. The imputation tax system is designed to eliminate the double taxation problem that exists with the classical tax system. Let’s look at Susan’s taxes, this time under the imputation tax system.