留学顾问の QQ:2128789860

留学顾问の微信:risepaper

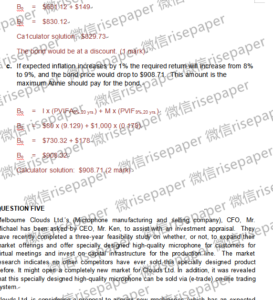

在学习代写BOND VALUATION的过程中,我们知道If a firm is planning to raise capital by issuing new bonds or invest in a bond market its accountants need to know various financial models used to estimate the intrinsic value of this bond in order to make informed financial or investment decisions

- 疫情之下的留学生,包括小编也在不断努力学习更新自己的理论知识和编程能力,争取永不掉队,挑灯夜读是家常便饭!只要坚持学,迟早成学霸!

- What will be Goulet’s share price if the previous dividend was D0 = $2 and if investors expect dividends to grow at a constant compound annual rate of -5 per cent, 0 per cent, 5 per cent or 10 per cent?

- The local council classify this investment as a strategic investment. Explain this classification and why it is not considered an operational investment.

- Management Accounting and Value Chain Analysis

Working Capital Management

Capital Structure Policy

Valuation of Bonds

Shares and Dividend Policies

Cost of Capital

Risk and Return

Capital Budgeting NPV and IRR (long-term investment)

Regulatory , operational and strategic investment

Sustainability aspect of investments - Capital Budgeting代写 (and strategic investments)也非常重要,Recognise the different categories of long-term capital investments

-OH&S or regulatory investments

-Operational or replacement investments

-Strategic investments

Be able to determine which tool is more appropriate for different categories of capital investments

Be able to use traditional and strategic capital budgeting tools to determine whether or not to invest in long-term capital investments

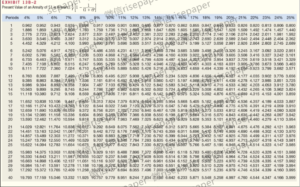

Tools that use DCF (discounted cash flows)

—NPV (net present value) and IRR (internal rate of return)

Traditional tools that do not necessarily use DCF

—Payback methods

Be able to develop strategic tools that recognise the limitations of the above techniques